China Country Summary

Medium-High Risk

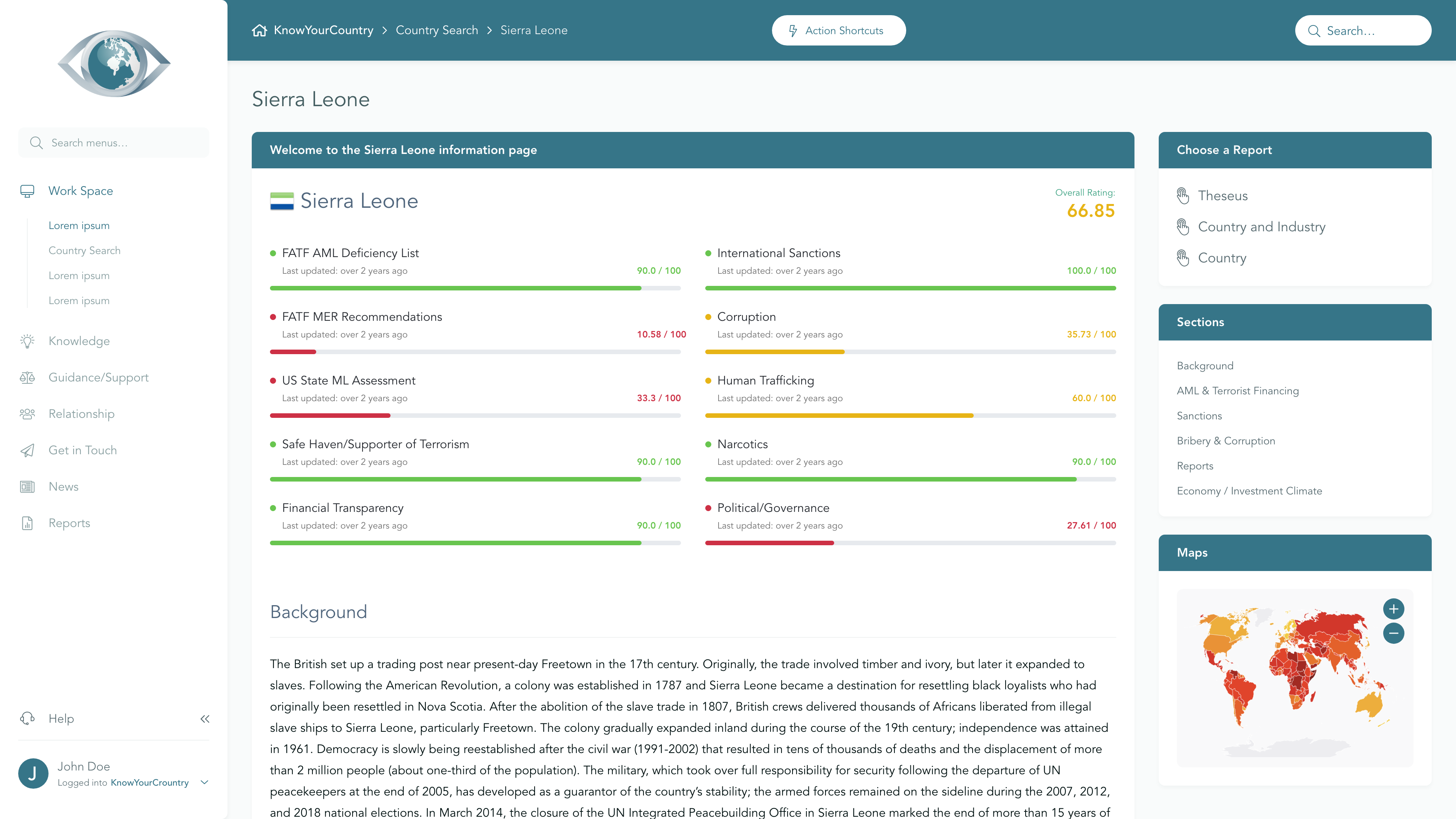

View full Ratings TableSanctions

Higher Concern

FATF AML Deficient List

Lower Concern

Terrorism

Medium Concern

Corruption

Medium Concern

US State ML Assessment

Higher Concern

Criminal Markets (GI Index)

Medium Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Lower Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

FATF Status

China is not on the FATF List of Countries that have been identified as having strategic AML deficiencies

Compliance with FATF Recommendations

The last follow-up Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in China was undertaken in 2022. According to that Evaluation, China was deemed Compliant for 9 and Largely Compliant for 22 of the FATF 40 Recommendations. It remains Highly Effective for 0 and Substantially Effective for 3 of the Effectiveness & Technical Compliance ratings.

Sanctions

As of mid-2025, several nations have imposed targeted sanctions on China, including asset freezes and visa bans by the United States (CMIC List and sectoral sanctions), arms embargoes and human rights sanctions by the European Union and the United Kingdom, Canada's human rights sanctions, Japan's export controls and entity sanctions, and Australia's export controls and tariffs; by contrast the United Nations has no sanctions in force against China, while New Zealand and Switzerland maintain no direct sanctions.

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | 43 |

| World Bank: Control of Corruption Percentile Rank | 54 |

China's ongoing anti-corruption campaign, initiated in 2012, has led to extensive investigations across various sectors, including government and state-owned enterprises, as the leadership views corruption as a significant threat to the Communist Party's stability. Despite these efforts, issues such as human trafficking, cybercrime, and organized crime persist, exacerbated by systemic vulnerabilities in governance and law enforcement, which struggle to address entrenched criminal networks effectively.

Economy

China's economy remains one of the most closed major economies globally, with a significant decline in foreign investment, which dropped by 27.1% in 2024, marking the steepest fall since 2008. Despite the Chinese government's rhetoric about opening up to foreign investment, the reality is characterized by a restrictive business environment, sluggish economic growth, and increasing legal and regulatory pressures on foreign companies, leading to heightened anxiety among U.S. and other foreign businesses. The Chinese Communist Party (CCP) continues to assert control over the financial system and foreign investment policies, emphasizing technology self-reliance and indigenization while imposing various restrictions that deter foreign participation in key sectors, thus complicating the investment climate for foreign entities.

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments