Iran, Islamic Republic of Country Summary

Higher Risk

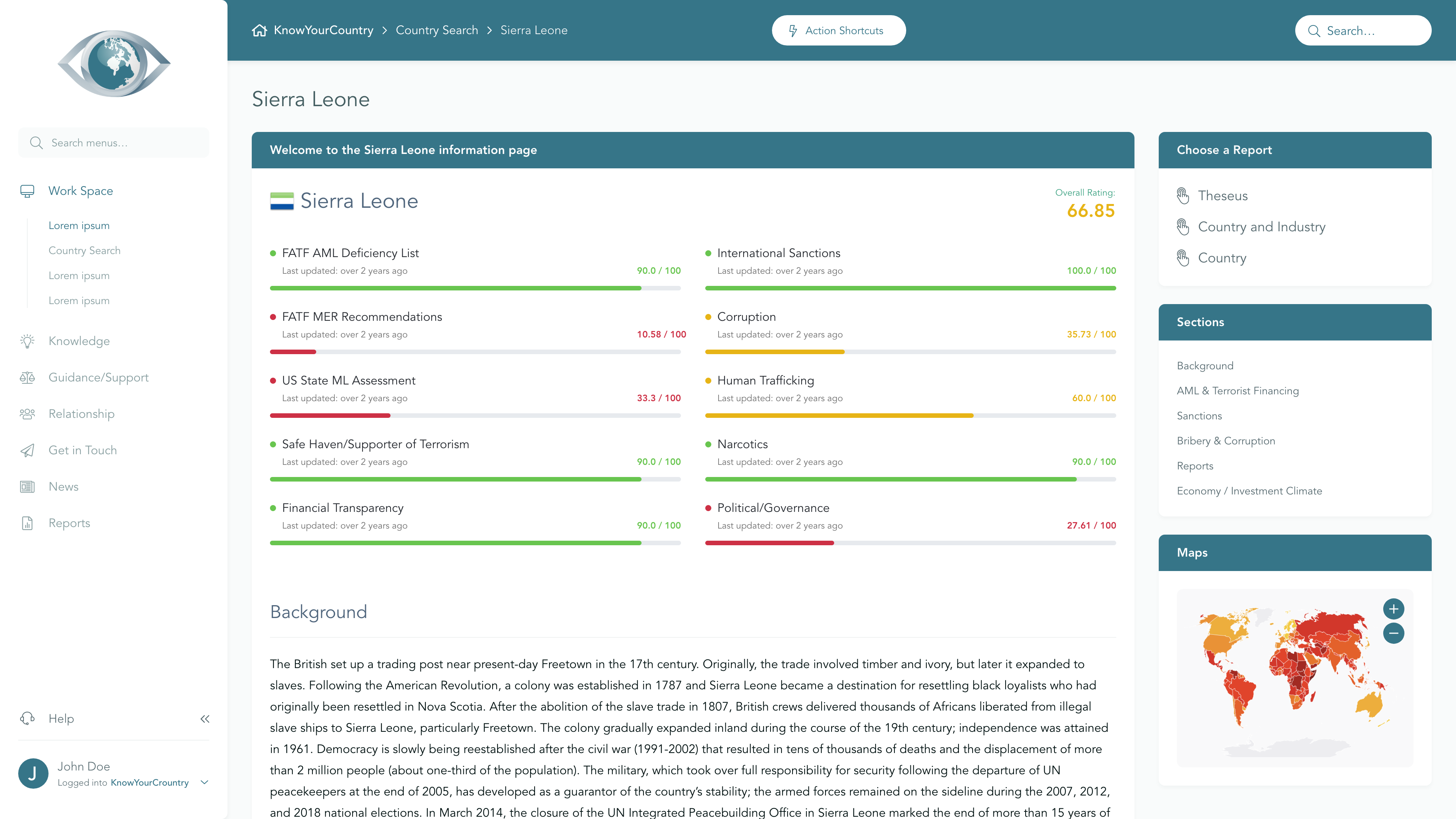

View full Ratings TableSanctions

Higher Concern

FATF AML Deficient List

Higher Concern

Terrorism

Higher Concern

Corruption

Higher Concern

US State ML Assessment

Higher Concern

Criminal Markets (GI Index)

Higher Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Lower Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

FATF Status

Iran is subject to a FATF call on its members and other jurisdictions to apply enhanced due diligence measures proportionate to the risks arising from the jurisdiction.

Compliance with FATF Recommendations

Iran has not yet undertaken a Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards.

Sanctions

A broad set of actors—United Nations, United States (OFAC), European Union, United Kingdom, Canada, Australia, Japan, New Zealand, and Switzerland among others—enforce sanctions against Iran, spanning nuclear proliferation, human rights concerns, and support for Russia’s war in Ukraine. UN arms embargo expired in 2020 and missile-related restrictions ended in 2023, with Resolution 2231 now focusing on nuclear proliferation and designated persons, while other jurisdictions maintain comprehensive or selective regimes with hundreds of designations (e.g., US, EU, UK, Canada, Australia) and the Arab League has no formal sanctions regime against Iran.

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | 23 |

| World Bank: Control of Corruption Percentile Rank | 10 |

Iran faces significant challenges related to crime and corruption, with widespread human trafficking, a pervasive illicit drug market, and rampant financial crimes. The governance system struggles to effectively combat organized crime, as anti-corruption efforts are often politicized, and the fragmented judicial system lacks due process, leading to a climate of impunity and human rights violations.

Economy

Iran's economy is a mixed system dominated by state ownership and central planning, particularly in the oil sector, which significantly contributes to its GDP. As of 2024, Iran ranks as the 19th largest economy globally by purchasing power parity, with key sectors including services, industry, and agriculture, although it faces challenges such as high inflation and international sanctions. The investment climate is hindered by state control and regulatory complexities, yet the government is attempting reforms to attract foreign capital, especially in tourism and technology, while also promoting diversification into sectors like biotechnology and pharmaceuticals amidst ongoing geopolitical tensions.

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments