Lao People’s Democratic Republic Country Summary

Higher Risk

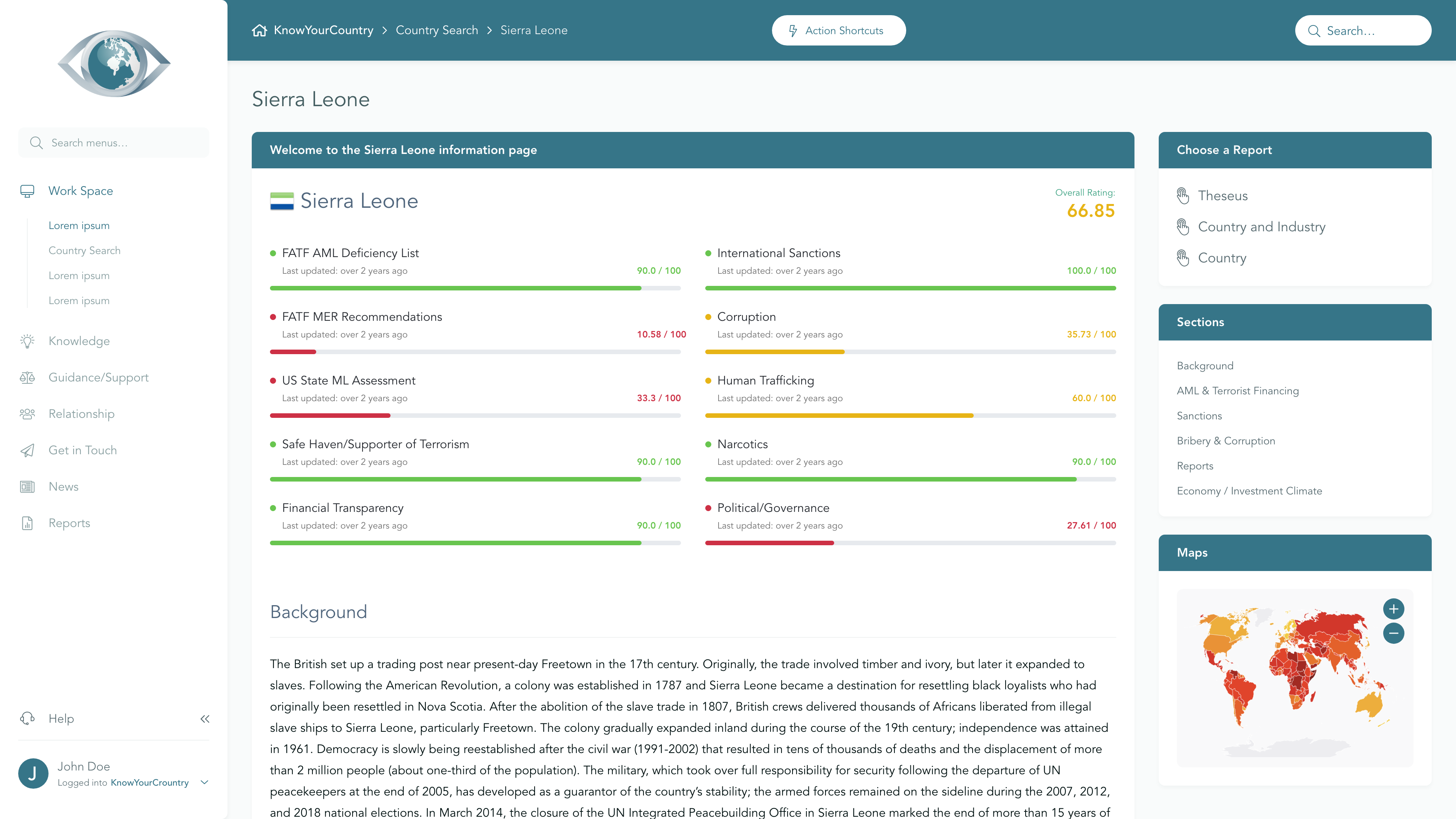

View full Ratings TableSanctions

Lower Concern

FATF AML Deficient List

Higher Concern

Terrorism

Medium Concern

Corruption

Higher Concern

US State ML Assessment

Higher Concern

Criminal Markets (GI Index)

Medium Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Lower Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

FATF Status

Laos is on the FATF List of Countries that have been identified as having strategic AML deficiencies

Compliance with FATF Recommendations

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Laos was undertaken in 2024. According to that Evaluation, Laos was deemed Compliant for 3 and Largely Compliant for 13 of the FATF 40 Recommendations. It was deemed Highly Effective for 0 and Substantially Effective for 0 with regard to the 11 areas of Effectiveness of its AML/CFT Regime.

Sanctions

There are currently no international sanctions in force against Lao People's Democratic Republic.

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | 34 |

| World Bank: Control of Corruption Percentile Rank | 20 |

Corruption is pervasive in the Lao People's Democratic Republic, significantly impacting the economy and deterring foreign investment, despite the existence of anti-corruption laws. The country faces numerous challenges related to organized crime, including human trafficking, drug smuggling, and illicit trade, compounded by weak law enforcement and a judicial system influenced by corruption.

Economy

The Lao People's Democratic Republic (Lao PDR) is a developing economy in Southeast Asia, experiencing average growth rates of nearly 8 percent prior to the COVID-19 pandemic, but recovering slowly with a projected GDP growth of 4.1 percent in 2024. The government has made strides in reforming its economic policies, particularly following its accession to the World Trade Organization in 2013, yet significant challenges remain, including high public debt, currency depreciation, and inflation, which has averaged over 23 percent in 2024. Foreign direct investment, primarily in mining and hydropower, is crucial for Laos, but the business environment is hindered by regulatory complexities, corruption, and a lack of skilled labor, prompting the government to seek diversification into agriculture, manufacturing, and tourism to enhance economic resilience and integration with neighboring markets.

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments