Niger Country Summary

Medium-High Risk

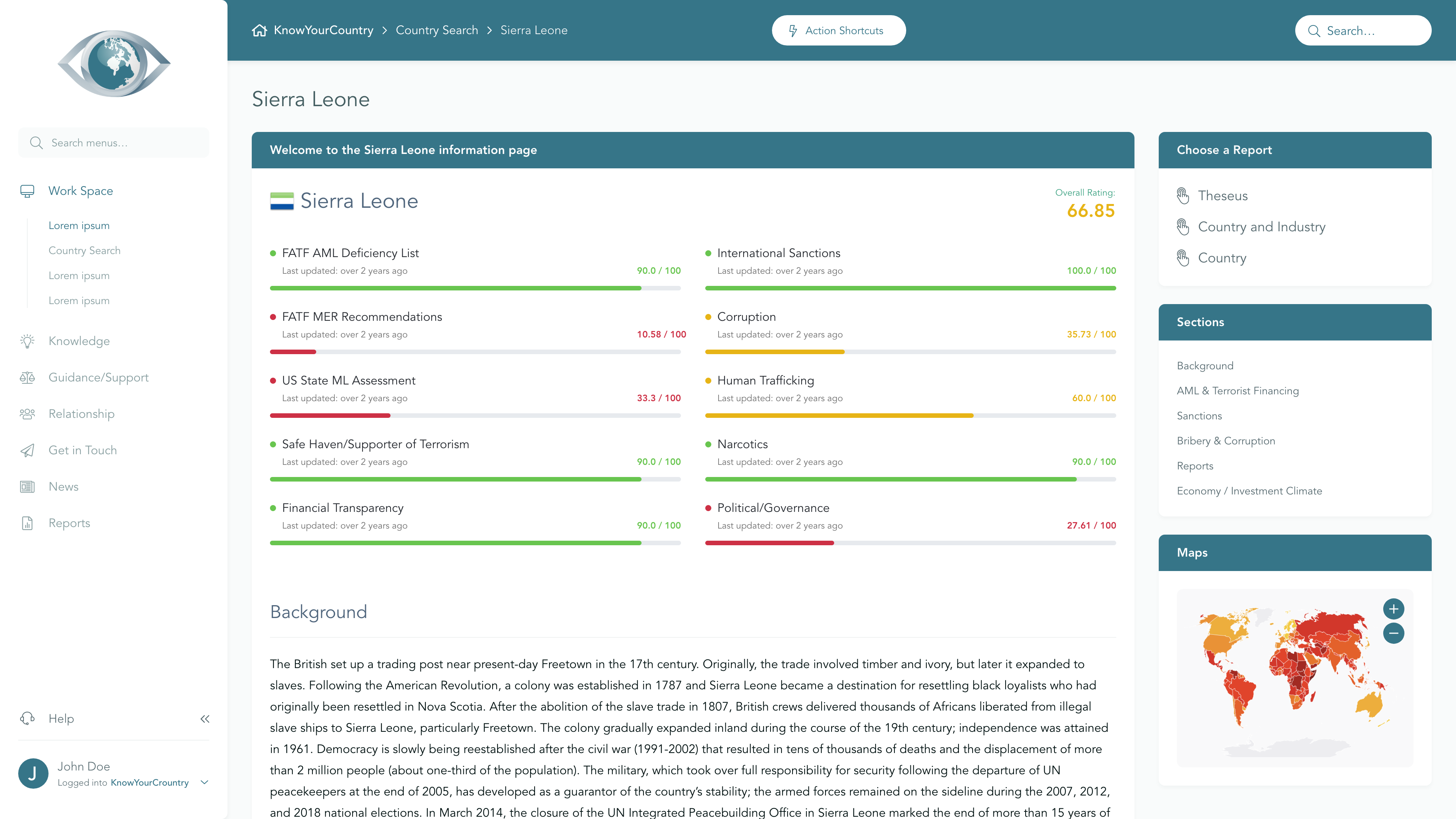

View full Ratings TableSanctions

Higher Concern

FATF AML Deficient List

Lower Concern

Terrorism

Higher Concern

Corruption

Higher Concern

US State ML Assessment

Lower Concern

Criminal Markets (GI Index)

Medium Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Lower Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

FATF Status

Niger is not on the FATF List of Countries that have been identified as having strategic AML deficiencies

Compliance with FATF Recommendations

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Niger was undertaken in 2021. According to that Evaluation, Niger was deemed Compliant for 10 and Largely Compliant for 16 of the FATF 40 Recommendations. It remains Highly effective for 0 and Substantially Effective for 0 of the Effectiveness & Technical Compliance ratings.

Sanctions

ECOWAS imposed comprehensive sanctions on Niger after the July 2023 coup, which were lifted on February 24, 2024 on humanitarian grounds. Beyond ECOWAS, the United States has not imposed comprehensive sanctions but suspended aid and maintains targeted terrorism-related designations (including a Niger national on OFAC's Specially Designated Nationals list); the European Union has established an autonomous sanctions framework but, as of June 2025, had not designated any individuals or entities, and a range of other major partners (United Kingdom, Canada, Australia, Japan, New Zealand, Switzerland, Arab League) have not imposed Niger-specific sanctions.

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | 31 |

| World Bank: Control of Corruption Percentile Rank | 32 |

Niger faces significant challenges related to crime and corruption, with pervasive issues in government procurement, human trafficking, and drug trafficking. Despite the government's efforts to combat these problems, including the establishment of anti-corruption bodies and participation in international initiatives, corruption remains widespread, and the judicial system struggles with executive interference and limited resources, undermining effective law enforcement and governance.

Economy

Niger's economy has shown promising growth, with Foreign Direct Investment (FDI) increasing over the past decade, driven by government reforms aimed at liberalizing the economy and attracting international investors. The anticipated launch of the new China National Petroleum Corporation pipeline in late 2023 is expected to significantly boost revenue, contributing to a projected real GDP growth of 6.9% in 2023 and 12.5% in 2024. However, challenges such as insecurity, limited infrastructure, and bureaucratic hurdles continue to deter potential investors, despite the government's efforts to create a more favorable business environment through initiatives like the High Council for Investment and the establishment of export processing zones.

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments