Sao Tome & Prin. Country Summary

Medium Risk

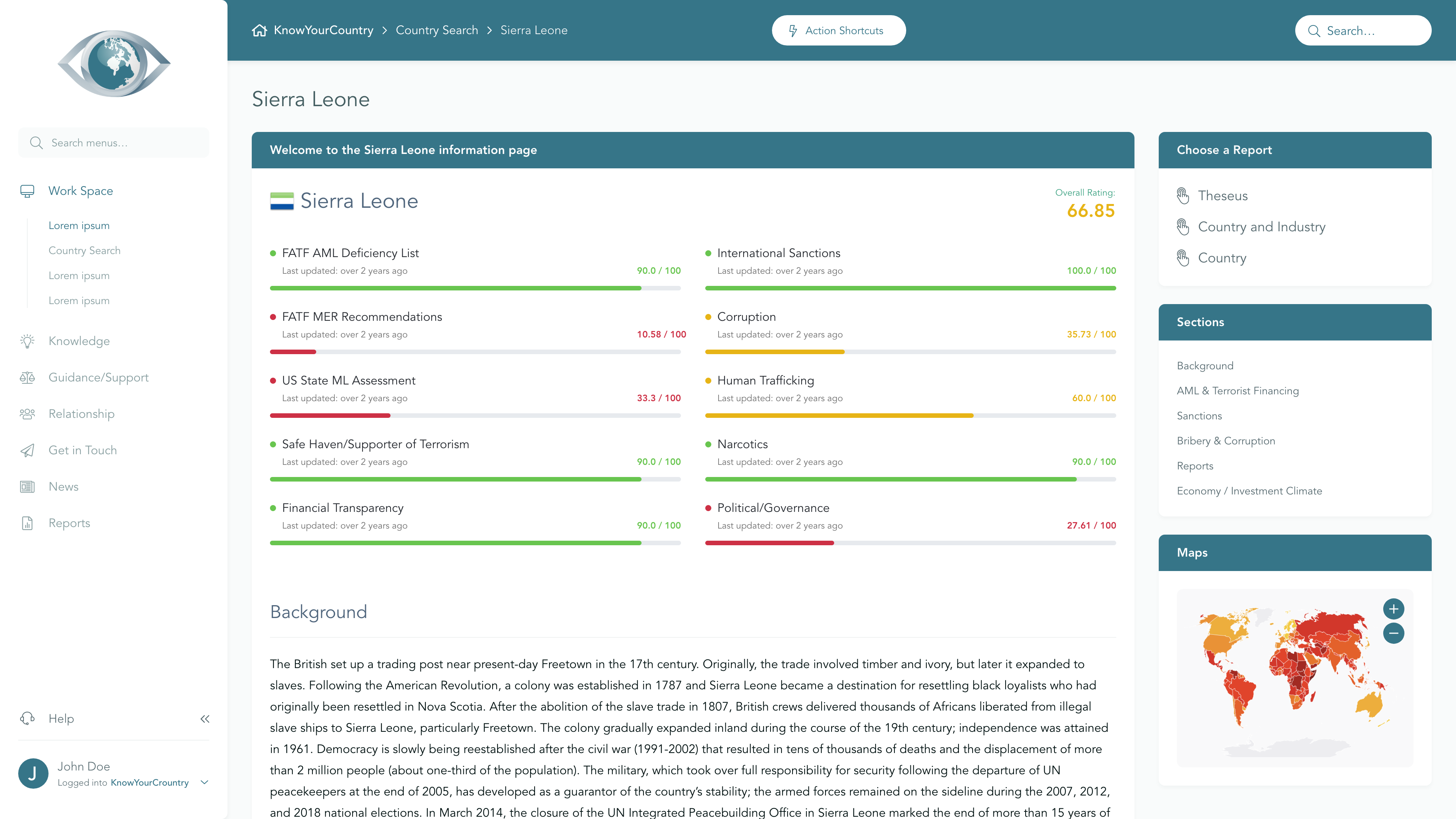

View full Ratings TableSanctions

Lower Concern

FATF AML Deficient List

Medium Concern

Terrorism

Medium Concern

Corruption

Medium Concern

US State ML Assessment

Lower Concern

Criminal Markets (GI Index)

Lower Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Lower Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

Compliance with FATF Recommendations

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in São Tomé and Príncipe was undertaken in 2024. According to that Evaluation, São Tomé and Príncipe was deemed Compliant for 5 and Largely Compliant for 11 of the FATF 40 Recommendations. It was deemed Highly Effective for 0 and Substantially Effective for 0 of the Effectiveness ratings.

Sanctions

There are currently no international sanctions in force against Sao Tome & Prin..

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | 45 |

| World Bank: Control of Corruption Percentile Rank | 63 |

São Tomé and Príncipe faces significant challenges with corruption and crime, despite government efforts to implement reforms and combat these issues. While the country has established anti-corruption legislation and shown some political will to address organized crime, corruption remains pervasive due to factors such as lack of accountability, cronyism, and insufficient resources for law enforcement and judicial processes.

Economy

São Tomé and Príncipe is actively enhancing its investment climate to attract foreign direct investment (FDI), focusing on transparency and anti-corruption measures, while heavily relying on foreign donors for public investment. The government, under newly elected Prime Minister Américo Ramos, aims to boost sustainable economic growth and improve essential services such as healthcare and education, while also fostering regional integration and social cohesion. Despite these efforts, challenges persist, including a fragile domestic market, inadequate infrastructure, and high costs of credit, which hinder foreign investors from fully capitalizing on the available opportunities in this small island nation.

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments