Zimbabwe Country Summary

Medium-High Risk

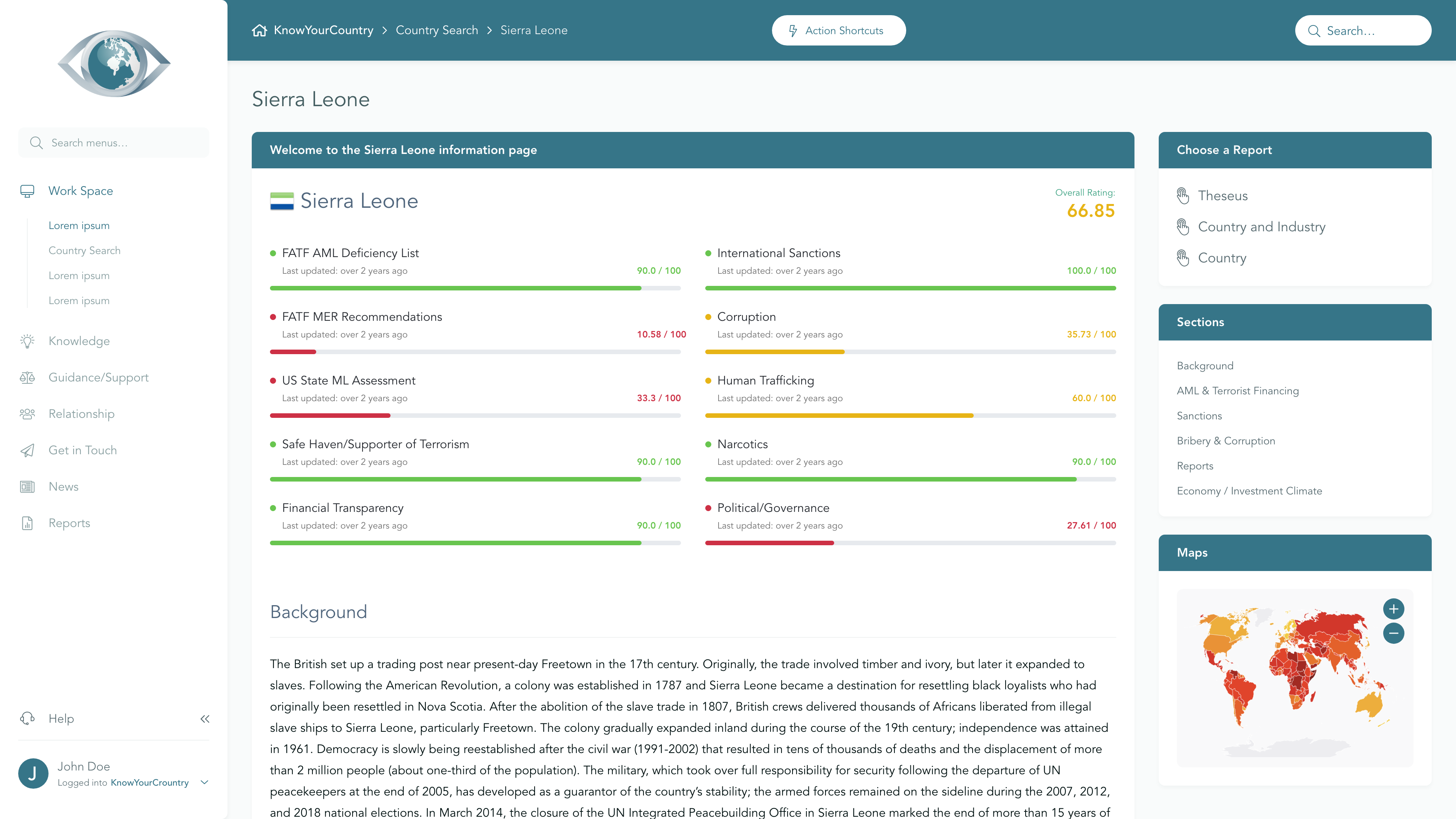

View full Ratings TableSanctions

Higher Concern

FATF AML Deficient List

Lower Concern

Terrorism

Medium Concern

Corruption

Higher Concern

US State ML Assessment

Medium Concern

Criminal Markets (GI Index)

Medium Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Lower Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

FATF Status

Zimbabwe is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies

Compliance with FATF Recommendations

The latest follow-up Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Zimbabwe was undertaken in 2024. According to that Evaluation, Zimbabwe was deemed Compliant for 20 and Largely Compliant for 17 of the FATF 40 Recommendations. It remains Highly Effective for 0 and Substantially Effective for 0 with regard to the 11 areas of Effectiveness of its AML/CFT Regime.

Sanctions

Beyond the United Nations, Zimbabwe is subject to targeted sanctions from several countries, with the United States ending its Zimbabwe-specific program in March 2024 but retaining Global Magnitsky sanctions on 11 individuals and 3 entities, and the United Kingdom, Canada, and Australia maintaining asset freezes, travel bans, and arms embargo provisions; the European Union's regime is now limited to an arms embargo with no designated individuals or entities since 2025-2026. Japan, New Zealand, and the Arab League do not maintain autonomous sanctions against Zimbabwe (Japan relies on UN measures that currently do not apply), while Switzerland aligns with EU rules and maintains only an arms embargo.

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | 22 |

| World Bank: Control of Corruption Percentile Rank | 10 |

Zimbabwe faces significant challenges related to crime and corruption, with endemic corruption severely hindering business operations and foreign direct investment. The government has established anti-corruption mechanisms, but enforcement is selective, often targeting individuals who have fallen out of favor, while many high-ranking officials evade accountability, contributing to a pervasive culture of impunity.

The country grapples with various criminal markets, including human trafficking, illicit trade, and drug trafficking, exacerbated by weak governance and a lack of resources for law enforcement. Additionally, the judicial system suffers from corruption and political interference, undermining public trust and the rule of law, while civil society organizations and journalists face repression, limiting their ability to advocate for transparency and accountability.

Economy

Zimbabwe presents a complex economic landscape characterized by significant potential for development alongside a challenging investment climate. The country is rich in natural resources, particularly in mining, agriculture, energy, and tourism, making it attractive for foreign direct investment (FDI). However, investors face hurdles such as policy inconsistency, corruption, and a lack of transparency in the regulatory environment, despite government efforts to improve conditions through initiatives like the Zimbabwe Investment Development Agency (ZIDA) and the establishment of Special Economic Zones (SEZs).

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments