St Kitts & Nevis Country Summary

Medium Risk

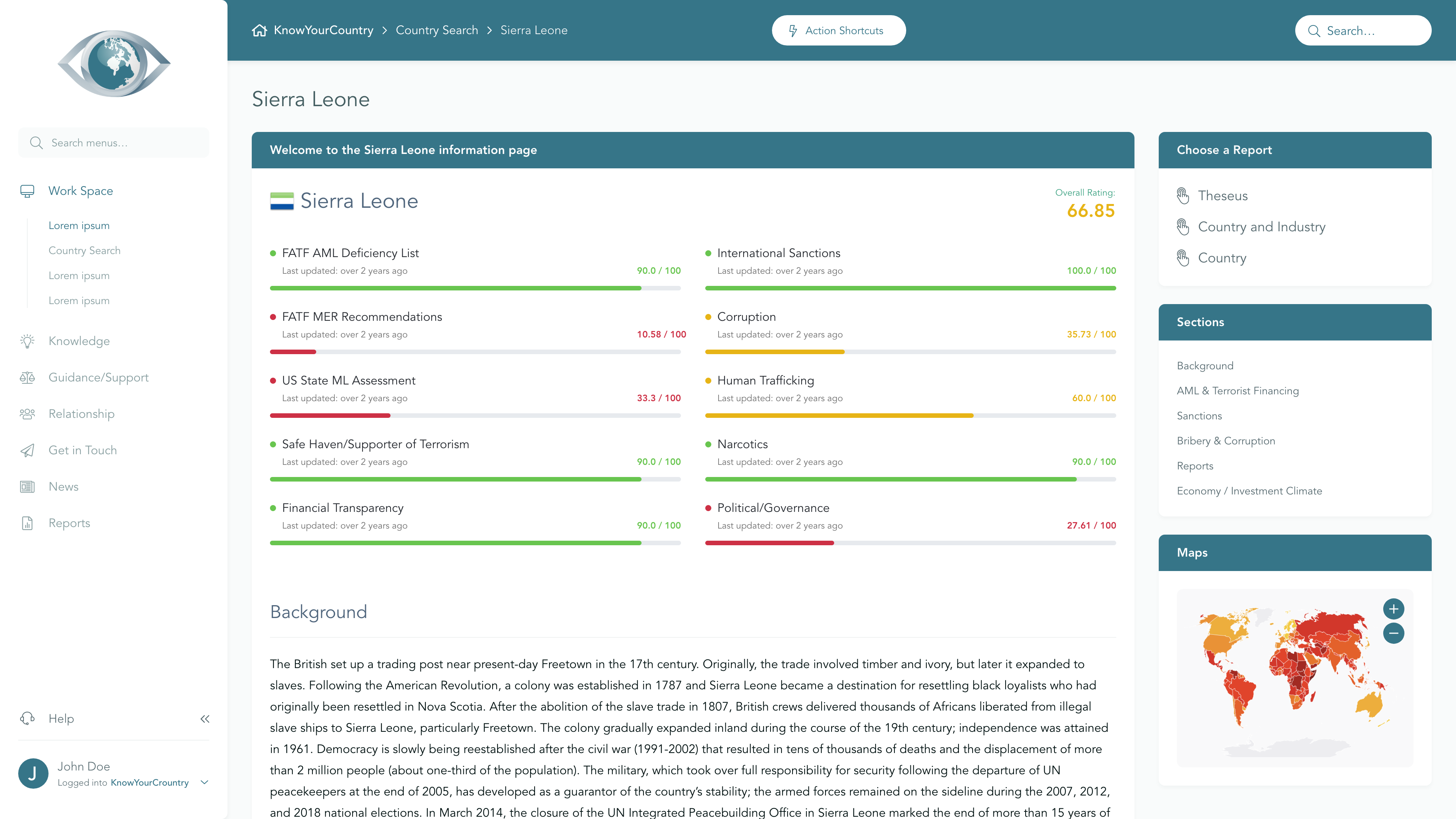

View full Ratings TableSanctions

Lower Concern

FATF AML Deficient List

Lower Concern

Terrorism

Medium Concern

Corruption

Medium Concern

US State ML Assessment

Higher Concern

Criminal Markets (GI Index)

Medium Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Higher Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

FATF Status

Saint Kitts & Nevis is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Compliance with FATF Recommendations

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in St Kitts and Nevis was undertaken in 2022. According to that Evaluation, St Kitts and Nevis was deemed Compliant for 11 and Largely Compliant for 15 of the FATF 40 Recommendations. It was deemed Highly Effective for 0 and Substantially Effective for 0 of the Effectiveness & Technical Compliance ratin

Sanctions

There are currently no international sanctions in force against St Kitts & Nevis.

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | NA |

| World Bank: Control of Corruption Percentile Rank | 65 |

St. Kitts and Nevis faces challenges related to crime and corruption, with government corruption reported occasionally despite the implementation of anti-corruption laws and the establishment of an office for a special prosecutor. The country serves as a transit point for human trafficking and drug trafficking, particularly cocaine, while its financial environment is conducive to tax evasion schemes, highlighting vulnerabilities in governance and law enforcement.

Economy

The economy of Saint Kitts and Nevis, a member of the OECS and ECCU, is projected to grow by 1.5% in 2024, despite facing vulnerabilities from external shocks like supply chain issues and global conflicts. The government actively promotes a favorable investment climate by identifying priority sectors such as agriculture, tourism, and renewable energy, and offers various incentives for both domestic and foreign investors, including the ability to repatriate profits and capital. With no restrictions on foreign ownership and a transparent regulatory framework, Saint Kitts and Nevis aims to attract foreign direct investment while ensuring that investments contribute positively to the local economy and create job opportunities.

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments