St Vincent & Gren Country Summary

Medium Risk

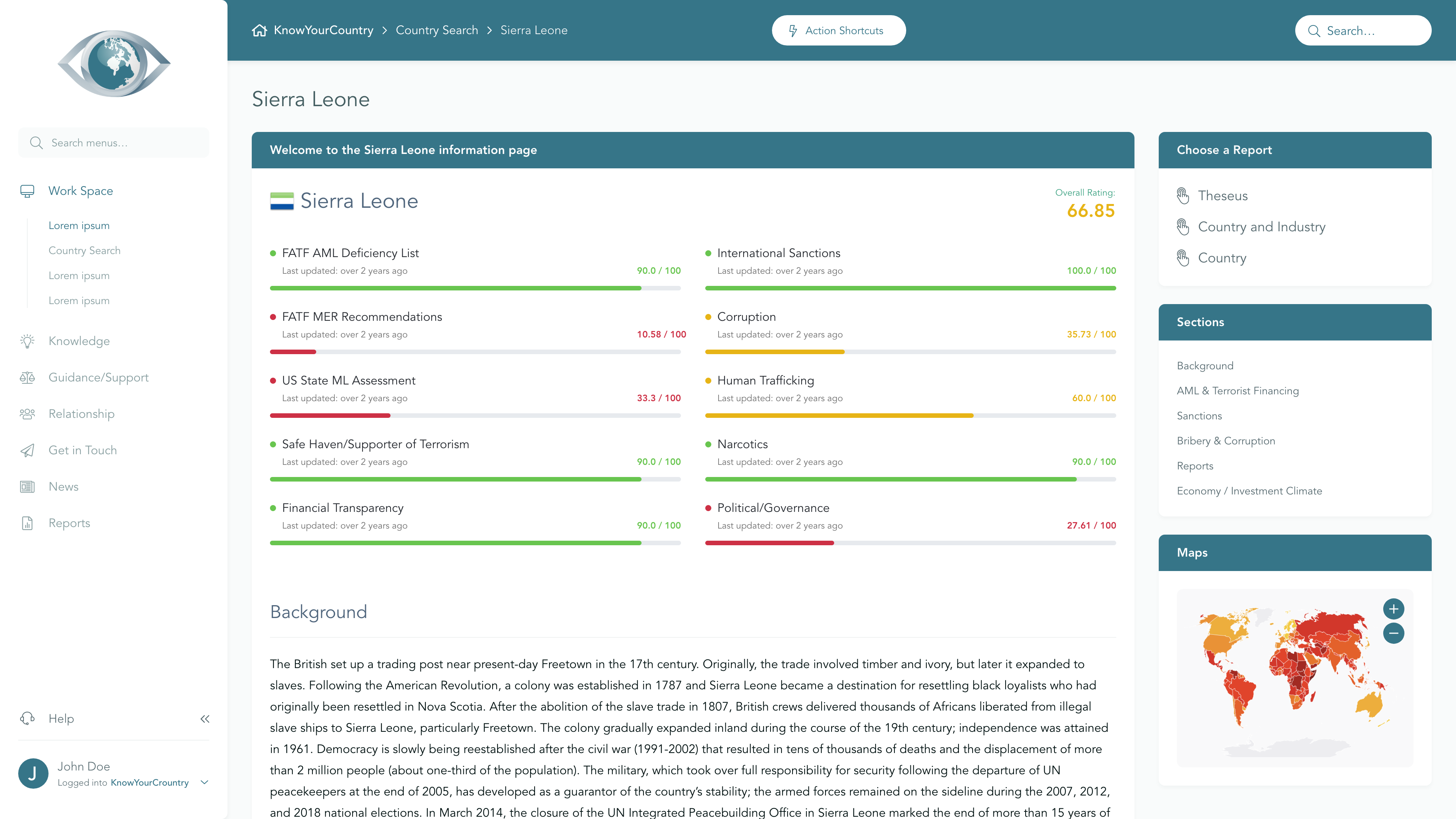

View full Ratings TableSanctions

Lower Concern

FATF AML Deficient List

Lower Concern

Terrorism

Medium Concern

Corruption

Medium Concern

US State ML Assessment

Higher Concern

Criminal Markets (GI Index)

Lower Concern

EU Tax Blacklist

Lower Concern

Offshore Finance Center

Higher Concern

Please note that although the below Summary will give a general outline of the AML risks associated with the jurisdiction, if you are a Regulated entity then you may need to demonstrate that your Jurisdictional AML risk assessment has included a full assessment of the risk elements that have been identified as underpinning overall Country AML risk. To satisfy these requirements, we would recommend that you use our Subscription area.

If you would like a demo of our Subscription area, please reserve a day/time that suits you best using this link, or you may Contact Us for further information.

Anti Money Laundering

FATF Status

St Vincent & the Grenadines is not on the FATF List of Countries that have been identified as having strategic AML deficiencies

Compliance with FATF Recommendations

The last Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in Saint Vincent and the Grenadines was undertaken in 2024. According to that Evaluation, Saint Vincent and the Grenadines was deemed Compliant for 13 and Largely Compliant for 17 of the FATF 40 Recommendations. It was deemed Highly Effective for 0 and Substantially Effective for 3 of the Effectiveness ratings.

Sanctions

There are currently no international sanctions in force against St Vincent & Gren.

Criminality

Rating |

0 (bad) - 100 (good) |

|---|---|

| Transparency International Corruption Index | 63 |

| World Bank: Control of Corruption Percentile Rank | 76 |

Saint Vincent and the Grenadines faces challenges related to crime and corruption, with laws in place to address official corruption and a framework for public access to information, although the effectiveness of these measures is limited by a lack of enforcement and accountability. Criminal activities such as drug trafficking and human trafficking persist, driven by both local and foreign actors, while the government is perceived as relatively transparent and committed to reform, despite resource constraints in the judicial system and law enforcement.

Economy

Saint Vincent and the Grenadines, a member of the OECS and ECCU, has shown resilience in its economy, with an estimated growth rate of 4.8 percent in 2024, despite vulnerabilities to external shocks such as natural disasters and global economic fluctuations. The government actively promotes foreign direct investment (FDI) across various sectors, including renewable energy, tourism, and international financial services, while maintaining an open dialogue with investors through the Invest SVG authority. With no restrictions on foreign ownership and a transparent regulatory framework, the country aims to enhance its investment climate, although it currently lacks a bilateral investment treaty with the United States.

Subscribe to

Professional Plus

- Unlimited Access to full Risk Reports

- Full Dataset Download

- API Access

- Virtual Asset Risk Assessments